Short Sales from a Seller's and Buyer's perspective.

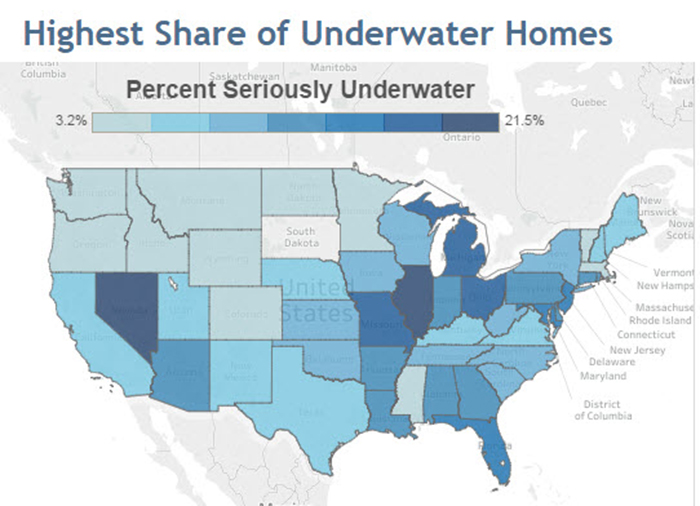

National Association of Realtors map from December 2016

If

you received a notice of foreclosure, are contemplating a

short sale, or have questions on loan As an

experienced agent and Equator-certified specialist,

Bill Baker has the experience to help you through this difficult and

emotional process.

All

conversations are confidential. The Bakers have helped both

buyers and sellers navigate the short sale process.

A seller

asks: I was reading online that if the

short sale goes through, we can be held responsible for

the difference between what we owe and what the house

sells for. Is this generally the case?

We'll help you with the short sale process, pre-qualify

you, and if you are approved, the primary lender will

forgive the debt. If there was a second or HELOC

on the property, then that needs to be negotiated prior

to the closing of the property.

If you have a second mortgage

such as an equity line of credit (HELOC) or a 80-10-10 or

80-20, the situation is more complicated.

Seconds must be negotiated upfront in the short sale

process. In almost all cases, this is negotiated

before closing in the form of a seller/buyer

contribution. So far we haven't heard of the PMI

companies chasing buyers on a primary residence after a

short sale. In most cases, they write it off their

books. But be aware that they retain the right to

pursue at a later date if this is not negotiated upfront. Our

short sale attorney tells us that that the MIP companies

are going after the lenders, looking for misrepresentation

(fraud) in the loan documentation process.

Obviously, the lenders have deep pockets and their chance

at getting money out of them is much better than with the

individual homeowner. If

a declared bankruptcy is on the horizon or has already

happened, a short sale is still possible; however, it

becomes much more complicated. Contact the Bakers

for more info at 847-927-2728.

modifications, don't panic, call the Bakers.

That leaves three concerns.

The IRS (which had the right to add the forgiven debt to

you as taxable income), the HELOC, if any, and the

MIP/PMI company, if any. Below is the IRS Mortgage

Forgiveness Debt Relief and Debt Cancellation Act.

Note this runs through 2014. The IRS does not add

the forgiven debt to your income if it is a primary

residence. That is great news. The property must close in

2013.

BUYING A SHORT SALE

__________________________________________________

Short

sales are transactions that take place between a buyer, seller, and

seller's lender. The seller's lender agrees to take

less than

it is owed because the proceeds of the sale are

not enough to pay off the entire amount owed the bank.

Many short

sales are never completed by the lender and after months of trying,

all parties give up. MIP, junior liens, hardship, lien holder

experience, and many other variables come into play. We run a

property through our short sale checklist before suggesting you

write an offer to see if it looks like a viable short sale. There is

no point waiting around tied up for months with a contract to see if

the process can even be completed.

The Bakers have extensive experience in short sales and can help both sellers and buyers with the process. Contact the Bakers if you are interested in this type of sale and need professional representation. You will need an experienced lawyer as well.

Below is from IRS publication 4681. Note IL is a recourse state

Connect With Us

Contact us today for more information - 847.255.9346

IvyHillHomes@gmail.com